tax appeal attorney nj

LLC trust etc the appeal must be prosecuted by an Attorney-At-Law admitted to practice in the State of New Jersey unless the subject propertys prior year taxes were less than 25000 in. Paterson NJ 07505 973 881-4000.

Tax Appeals Marmero Law Firm Nj

The tax appeal generally requires the help of a lawyer.

. If the app eal is from a final decision of a state agency enter the name of the agency for example Department of Labor. Deeds now searchable from 01011970 to present. Tax payments can be made online via e-check and credit card.

The appeal must be filed in person at a local unemployment office or the temporary disability service office or by writing to. In criminal cases enter the complaint accusation or indictment numbers. Website Design By GRANICUS - Connecting People and Government.

For more information about ACH credit payments contact the Employer Call Center at 919-707-1150. A Power of Attorney may be required for some Tax Audit Notice Services. Taxpayer Advocate Service For assistance and guidance from an independent organization within IRS call 877-777-4778.

If the appeal is not filed within the appeal periods an explanation of why it was not filed within that time limit. Our network attorneys have an average customer rating of 48 out of 5 stars. Check cashing not available in NJ NY RI VT and WY.

If you believe this web site is inaccurate or misleading you may report same to the Committee on Attorney Advertising Hughes Justice Complex CN 037 Trenton NJ. Case Information Statement a Service and Filing in Judicial Proceedings. On February 22 2021 Mazars provided millions of pages of Donald Trumps financial documents to the Manhattan District Attorney including his tax returns from January 2011 to August 2019.

If the amount of tax due is less than 500 no payment is required but a report must be submitted. Your attorney will likely charge you a feesometimes a portion of the savings on your tax bill if your appeal is approved. If approved you could be eligible for a credit limit between 350 and 1000.

This abstract of judgment is taken to the county recorders office in each county where the. But the property tax system is somewhat labyrinthine and you do need to know the rules. Once this time has passed the judgment creditor can acquire an abstract judgment form from the clerks office at the court were the case was heard.

Tax Board appeals have changed. DES also accepts ACH credit payments initiated through your financial institution. The appeal deadline for these counties only is on or before January 15 or 45 days from the date the bulk mailing.

You can appeal the decision if you dont agree with the outcome. Rule 25-1Notice of Appeal. IRS LiensWithdrawalsReleases are now searchable from 112010 to present.

Check cashing fees may also apply. If a m unicipal appeal enter the Law. Appeal Tribunal PO Box 907 Trenton NJ 08625-0907.

The Appeal Tribunal PO Box 907 Trenton NJ 08625 Alternatively you may file an online appeal here. Consult your own attorney for legal advice. By March 19 2021 Trumps former personal lawyer Michael Cohen had met eight times with investigators for the Manhattan District.

Theres absolutely nothing fun about it. Get the right guidance with an attorney by your side. In civil cases enter the trial court docket number.

For more information see Publication 1660 Collection Appeal Rights PDF. Attorneys must order their transcripts through eCourts Appellate. A Power of Attorney may be required for some Tax Audit Notice Services.

If your transcript request is for a Tax Court case and is not related to an appeal please fill out the court transcript request form. If approved you could be eligible for a credit limit between 350 and 1000. An appeal from the final judgment of a court is taken by serving a copy of a notice of appeal and the request for transcript upon all other parties who have appeared in the action and in adult criminal matters upon the.

Ordering Process for Attorneys. Power of Attorney-35 for the first page 10 each additional page. The Anti-Fraud Toolkit was designed to provide senior citizens with.

Tax Audit Notice Services include tax advice only. Before a person can get a judgment lien he or she must usually wait for the time to appeal to lapse. Before making your choice of attorney you should give this matter careful thought.

Rule 25 - How to Appeal. The Cyber Savvy Youth webpage is maintained by the DCA and provides NJ youth the resources to protect their information and that of their friends and family. Check cashing fees may also apply.

Local newspaper covering news sports police fire and government issues for Nutley NJ 07110. Order in Lieu Thereof. The analysis is ongoing.

Maybe game is the wrong word. The selection of an attorney is an important decision. If you require additional time to prepare for the interview you may request a.

Part Mercer County or Tax Court. Federal Tax Lien. Check cashing not available in NJ NY RI VT and WY.

You may represent yourself or you may be represented at your own expense by an attorney or a non-attorney. If your transcript request is for a Superior Court case and is not related to an appeal contact the local county transcript office directly. NJ New Jerseys back-to-school sales tax holiday begins Saturday August 27 and runs.

How to appeal a determination or decision against you for Unemployment Insurance benefits. Office of Appeals Under certain circumstances you may be able to appeal the filing of a Notice of Federal Tax Lien. Know how this game works.

Tax Attorneys New Jersey Tax Law Mandelbaum Barrett Pc

Morris County Real Estate Law Commercial And Residential Tax Appeals Irwin Heinze P A

Fall Into Tax Appeals The Value Of Starting Early Szaferman Lakind

Nj Property Tax Appeals Toussaint Associates Llc

New Jersey Property Tax Appeal Attorneys Reach Us Now Company Logo Tech Company Logos Attorneys

Receiver Of Taxes Town Of Oyster Bay

News Publications New Jersey Divorce Attorneys Tax Appeal Lawyers

Tax Appeals Garber Law Offices

New Jersey Property Tax Dispute Right Just Now Tax Attorney Property Tax Doctor Robert

Warren Taxation Tax Law Attorney Herold Law P A

Property Taxes The Choi Law Group

New Jersey Property Tax Dispute Right Just Now Tax Attorney Property Tax Doctor Robert

How To Appeal Your Property Tax Assessment Learn About Law Youtube

New Jersey Office Commercial Property Tax Appeal Attorneys

Property Tax Appeals Kevin M Regan New Jersey Personal Injury Divorce Attorney

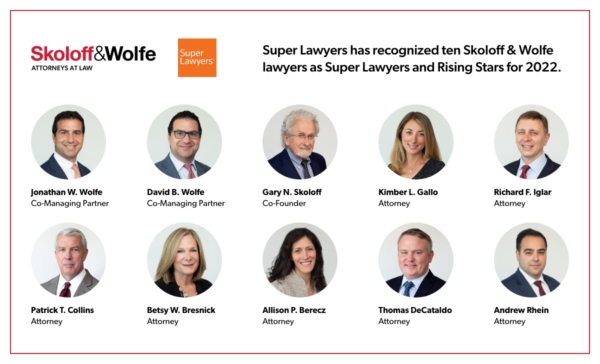

Skoloff Wolfe Listed Among Nj S Best Commercial Property Tax Appeal Law Firms Skoloff Wolfe

News Publications New Jersey Divorce Attorneys Tax Appeal Lawyers

Nj Tax Appeal Processes Reach Us Now Doctor Robert Appealing Tax